Can I Use Paypal to Sell Event Tickets

Fintech was one of the most impressive growth stories of 2017. Card payment incumbents Visa (V) and MasterCard (MA) saw returns of ~40%. PayPal (PYPL) gained ~83% thank you to its double-digit growth in cardinal areas, Venmo hype and a strengthening balance canvass. PayPal's smaller competitor Foursquare (SQ) saw the most explosive share price growth, gaining 151% in 2017. I think information technology'due south fair to say that investors have finally bought into CEO Jack Dorsey'south vision and execution of digitizing offline retail (by very rough estimates, offline retail still represents xc-95% of worldwide commerce) and recognized tremendous growth that this opportunity could bring.

Fintech was one of the most impressive growth stories of 2017. Card payment incumbents Visa (V) and MasterCard (MA) saw returns of ~40%. PayPal (PYPL) gained ~83% thank you to its double-digit growth in cardinal areas, Venmo hype and a strengthening balance canvass. PayPal's smaller competitor Foursquare (SQ) saw the most explosive share price growth, gaining 151% in 2017. I think information technology'due south fair to say that investors have finally bought into CEO Jack Dorsey'south vision and execution of digitizing offline retail (by very rough estimates, offline retail still represents xc-95% of worldwide commerce) and recognized tremendous growth that this opportunity could bring.

PYPL information by YCharts

PYPL information by YChartsFoursquare has been touted every bit a potential target for PayPal for some time now. At that place are some clear strategic motives for PayPal to pursue this acquisition, which we will expect at below, simply has Square go likewise expensive an acquisition for PayPal given that the company'south market cap has more than doubled over 12 months? This is exactly what this article volition discuss, with a simple merger model presented below to answer some key questions almost the acquisition, if it were to happen in the coming weeks.

Strategic Considerations

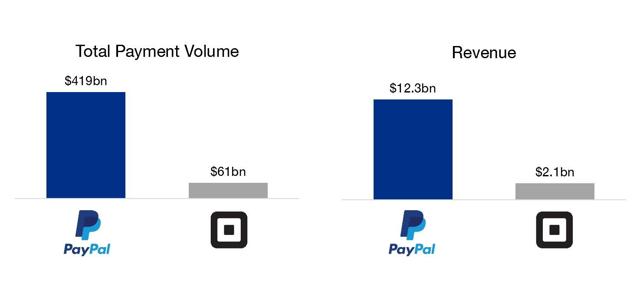

Earlier examining how Square might fit into PayPal financially, let'southward examine how the companies compare strategically. The primal takeaway is that aside from several overlaps (e.grand. Square payment terminals and PayPal Here) the 2 companies seek to accost different markets. PayPal seeks to address ecommerce merchants of all sizes – from simple internet start-up shops to large multinational corporations such as Uber, Netflix and Ryanair where payment via PayPal is possible. The cadre focus and the main source of profitability for PayPal, however, are medium- to large enterprises. Square, on the other paw, seeks to address small- to medium-sized businesses. In its 2022 Investor Day presentation, the company estimates that in the United states there are 21M such businesses which would approximately bring $3TN in TPV, which in turn should yield about $26BN in revenues. As of Q1'17, SQ accomplished a penetration rate of less than 3% within this addressable market place. This potential $3TN Us TPV is more than than seven times PayPal's global TPV currently. Lastly, small and medium sized businesses are for the most office price takers and do not have the opportunity to negotiate lower take rates in render for volume and visibility as big companies tin can with PayPal. I admit that SMEs can likewise have their business organisation to Stripe, iZettle, AdYen or another competitor, simply the indicate prevails that SMEs are a more assisting segment of the digital payments marketplace. If we accept the crudest (and illustrative at best) judge of have-rate possible (Revenue/TPV) for both companies during trailing 12 months, PayPal achieves a take-rate of 2.9%, while Foursquare boasts 3.5%. In fact, Nomura'southward recent equity research slice argues that Square's take-rate/yield should remain stable as payment book grows. This is, of form, a highly speculative signal and I would yet expect take rate deterioration for Square but I believe that the main point remains: achieving even a 25% penetration in the minor- to medium-business organisation space could increase PayPal's scale exponentially as well equally boost profitability.

(Estimate TTM TPV, based on PYPL and SQ 10-Q filings)

(Estimate TTM TPV, based on PYPL and SQ 10-Q filings)

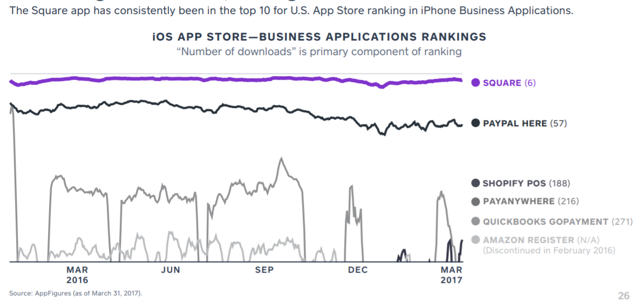

The acquisition would also significantly strengthen PayPal's strategic position in the point of sale (POS) marketplace, where PayPal Here competes with Foursquare's swipe readers and terminals. Currently, the U.S. pricing for the two services is almost identical: Square charges 2.75% for swipe/dip/tap transactions (PayPal Here charges 2.70%) and three.15% + $0.fifteen per keyed-in transaction for both Square and PayPal Hither. Consolidation of the 2 products (probably nether the stronger Square brand) tin bring about some synergies and provide another style for PayPal to promote Venmo.

(Source: Foursquare Investor Twenty-four hours 2022 Presentation)

Similar arguments can exist fabricated for Square's ecommerce and business management tools which tin can be consolidated into PayPal's. Some areas such as Caviar are more tenuous and may have to be sold.

PayPal will also be able to scale Foursquare internationally. Currently, Square is only bachelor in the major Anglophonic nations plus Japan. PayPal has a strong presence in EMEA and a more than modest one in APAC. PayPal has a European cyberbanking license with a banking construction in Luxembourg. This is a valuable asset with which PayPal tin launch Square at scale in all EU countries and offer an extended range of services. With the global economic system growing at a steady clip, diversification into Europe and Asia appears to be a logical next step.

Speaking financially, an acquisition of Square helps PayPal kill ii birds with i stone – information technology will eliminate an emerging strong competitor and information technology bring further growth to the company in areas where PayPal would like to be more than nowadays. Information technology's true that PayPal has salubrious growth upwards of xx%, only Square is growing due north of 30% and is much more focused on the SME space every bit discussed above. This comprehensive presence beyond big and small businesses would help to reach Dan Schulman's fuzzy vision of having customers use PayPal at least once a twenty-four hours.

Merger Model

Let's talk numbers. How big of a premium will Square's board want for them to recommend the deal to their shareholders? Which premium will go on activist investors such every bit Elliott Direction at bay? Can PayPal afford Square + premium given SQ'due south steep share cost growth? If so, how can information technology finance such a merger? What synergies tin exist expected from this merger? Well, the truth is that I don't know. But by analysing various scenarios and edifice some sensitivity tables we will be able to see what premium PayPal can beget to pay, how much equity information technology can event and how much debt information technology can raise. We will run into EPS accretion/dilution for each scenario and determine the level of synergies needed for the deal to be at least EPS neutral. Given how expensive Square is using traditional multiples, we can reasonably say that the rationale for acquiring the target volition have to exist more of a strategic one rather than a fiscal.

I'grand conscious of the fact that I'm writing this commodity but a couple of weeks earlier we will take FY2017 numbers available. PayPal could well take some material update on how tax cuts bear upon the visitor'due south remainder sheet merely this analysis uses the Q3 balance canvass figures which are the latest available. Think of it as a bourgeois scenario, since taxation cuts may well amend the picture there. For income argument items, I'thou using mean analyst projections taken from Thomson Reuters Eikon, which again, should be quite accurate for FY2017 and reasonable estimates for profitability going forward.

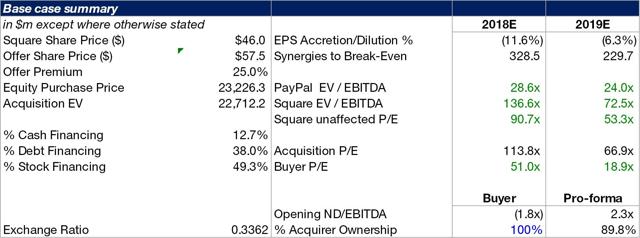

PayPal has virtually $4.9B of cash and brusk-term investments and no debt. Its market place cap is $102.6B and its Enterprise Value is $97.7B. Foursquare is currently worth $18.5B (and an EV of $18B). PayPal trades at 2022 EV/EBITDA of ~24x, while SQ trades at ~72x. Square is indeed expensive by whatever traditional metric.

For the base instance I volition assume a 25% share price premium with a 50% stock consideration. I volition also assume nix synergies. This base of operations case is a stab in the air regarding financing and valuation, but since nosotros are running sensitivity tables information technology doesn't matter how accurate information technology is in one case information technology'due south in the general ballpark. In all scenarios, I'm making an assumption that PayPal can pay $3B in cash from its remainder canvass. This volition leave PayPal's cash and brusk term investment balance at almost $2B, which I think is a reasonable corporeality to go on its existing operations. I'yard also bold ane.5% of advisory fees on top of the acquisition enterprise value of the target.

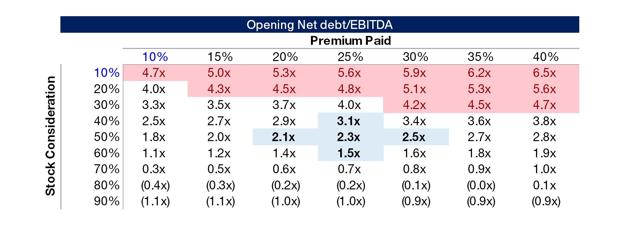

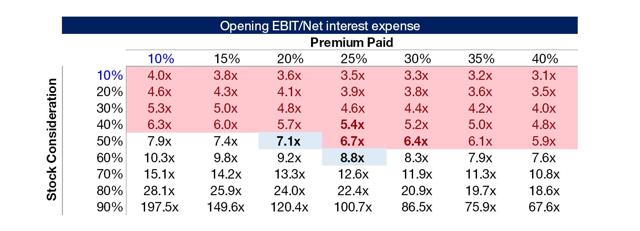

In the base case, Foursquare's equity purchase price is $23.2B. Adding $341M of advisory fees on meridian we have a total use of funds of $23.6B. $3B volition exist paid from existing cash. With a 50% stock consideration, PayPal equity issuance will raise another $11.6B, and finally $9B of debt will exist raised to cover the residue. At electric current income statement projections from analysts, the combined entity will be 12% dilutive to EPS in 2022 and half-dozen% dilutive in 2019. The pro-forma entity will also have a Net Debt/EBITDA of 2.3x and EBIT/Interest Expense of 6.7x. Current PayPal shareholders will have 89.viii% ownership in the combined entity. You will need $330M of synergies in 2022 for the deal to break even and $230M in 2019.

(Source: own model)

(Source: own model)

Many will find my base of operations example assumptions unrealistic, so it's more useful to expect at sensitivity tables based on these parameters.

(Source: own model)

(Source: own model)

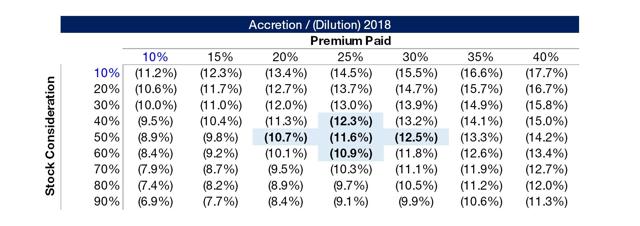

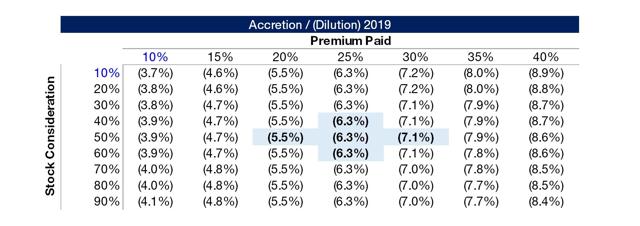

Looking at the EPS Accretion/Dilution Analysis nosotros tin see that assuming zero synergies, all variations of stock consideration and premium paid will requite an EPS-dilutive deal in 2022 and 2019. However, dilution is less the more equity PayPal problems to finance the acquisition. This makes sense, considering PayPal'due south stock has as well appreciated 83% in 2022 and a farther sixteen% YTD in 2018. This makes PayPal stock a powerful means of payment for the company and if in that location is a skilful time to finance deals using equity, then this year would be it for PYPL. Interestingly, even a xl% share price premium volition deteriorate EPS by less than 20% this year.

This brings u.s. to the next important question: how much of cyberspace synergies will the bargain have to generate to brand upward for this dilution?

(Source: own model)

(Source: own model)

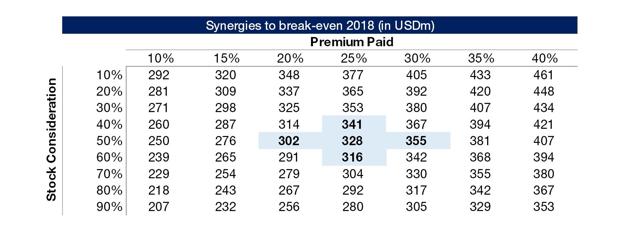

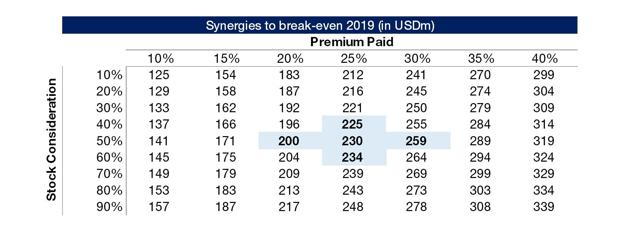

My model indicates that anywhere betwixt $200-460M in 2022 and $160-300M in 2019. This is almost certainly an unachievable task in 2018, provided that are synergies typically non realized in the year of the acquisition. Comparing this with Foursquare's projected EBIT of $207M in 2022 and $356M in 2019, PayPal would certainly be hard pressed to find these cost savings and cross selling opportunities. We can clearly see that PayPal volition non be able to use synergies alone as a justification for this conquering.

Finally, let's have a elevation-level look at credit assay, since PayPal volition probably have to issue debt to bring this deal over the line. Here, there are certain limitations to PayPal's debt capacity despite their current debt-free residue canvas.

(Source: ain model)

(Source: ain model)

PayPal volition probably not take an investment grade if its Cyberspace Debt/EBITDA is higher than 4x, and so I've used this as a cut-off point for leverage. Similarly, credit rating agencies will exist reluctant the rate PYPL higher than BB+ if their EBIT/Net Interest Expense are lower than 7x. In this model, this restricts PayPal to finance more half of the acquisition using equity. The base case of 25% premium and 50% stock is below the waterline for the EBIT/Net Interest expense requirement. It'south non a good thought for a tech company to lever upwards this much at the tiptop of the cycle, and then this reinforces the point that PYPL must issue equity to finance the bargain.

Determination

There are some obvious strategic reasons for PayPal to buy Square, every bit I've outlined higher up. Unfortunately, the visitor should take been acquired one year ago, when its valuation was a lot more reasonable. At current levels, the merely realistic way for PayPal to finance the acquisition is past issuing the bulk of the ticket cost in equity and levering upwards to fund the remainder and live with significant EPS dilution. Despite being in my opinion a great fit for PayPal, in that location is absolutely limited scope for synergies in this deal when compared to the target's EBIT and how much would be needed to make the deal EPS accretive. I believe that this deal nonetheless makes a lot of sense for PYPL, just it is a much more than risky movement now than it would accept been one yr ago. PayPal'southward executives will confront many difficult conversations with the lath and investors about the strategic management of the visitor should they pursue this conquering. In that location are other takeover targets for PayPal on both sides of the ocean and Square may non exist the best fit. But one matter is likely: competing with Foursquare could plow out a lot costlier for PayPal in a few years time.

This article was written by

An investment professional with a generalist approach, interested in long-term fundamental winners in structurally attractive end markets. The goal is to discover investments capable of chirapsia the wider stock market and/or provide a xv% equity IRR on a medium to long-term basis.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the adjacent 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Blastoff). I have no business organization relationship with whatever company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4141013-paypal-and-square-analysing-potential-acquisition

Post a Comment for "Can I Use Paypal to Sell Event Tickets"